Quote:

Originally Posted by sloride

The term carbon credits is a tax on energy producers. That is just a fancy way to sell that tax, and enrich a few politicians. Who in their right mind would suggest that mining coal in WV then shipping it to China on a steam ship propelled by oil then burned there is any kind of solution to Co2 emissions?

|

Yes, its a tax on energy producers who themselves receive tax deferrals, tax exemptions, low cost or no cost leases on public lands... the list of subsidies oil, natural gas and coal producers have been receiving for the past century is a very very long one and in the process they kept politicians in their pocket with kick backs, campaign contributions and other fun little incentives to write legislation and vote their way. And now one state out of 50 has rigged the game against the oil industry and we're all supposed to be outraged?

***** please

Quote:

According to the most recent study by the Congressional Budget Office, released in 2005, capital investments like oil field leases and drilling equipment are taxed at an effective rate of 9 percent, significantly lower than the overall rate of 25 percent for businesses in general and lower than virtually any other industry.

And for many small and midsize oil companies, the tax on capital investments is so low that it is more than eliminated by var-ious credits. These companies’ returns on those investments are often higher after taxes than before.

|

As Oil Industry Fights a Tax, It Reaps Subsidies

Quote:

Over the past century, the federal government has pumped more than $470 billion into the oil and gas industry in the form of generous, never-expiring tax breaks. Once intended to jump-start struggling domestic drillers, these incentives have become a tidy bonus for some of the world's most profitable companies.

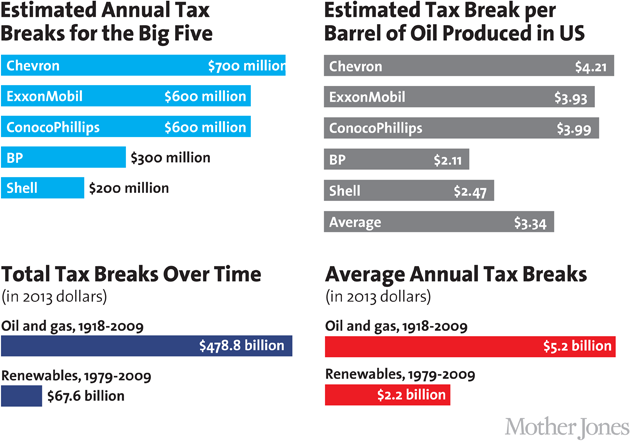

Taxpayers currently subsidize the oil industry by as much as $4.8 billion a year, with about half of that going to the big five oil companies—ExxonMobil, Shell, Chevron, BP, and ConocoPhillips—which get an average tax break of $3.34 on every barrel of domestic crude they produce.

|

http://www.motherjones.com/politics/2014/04/oil-subsidies-renewable-energy-tax-breaks

The privately owned and publicly subsidized energy companies found in the United States are the exception to the rule. As I said before, most of the world's energy is produced by government run monopolies that collude with each other to manipulate price and supply. Its impossible for any private energy company to compete in the world energy market without government support. As much as some people find subsidies and tax breaks distasteful, they are necerassy if you want a domestic energy industry that can be competitive with imports. Expecing renewable energy to compete in this environment without any subsidy is just plain silly.